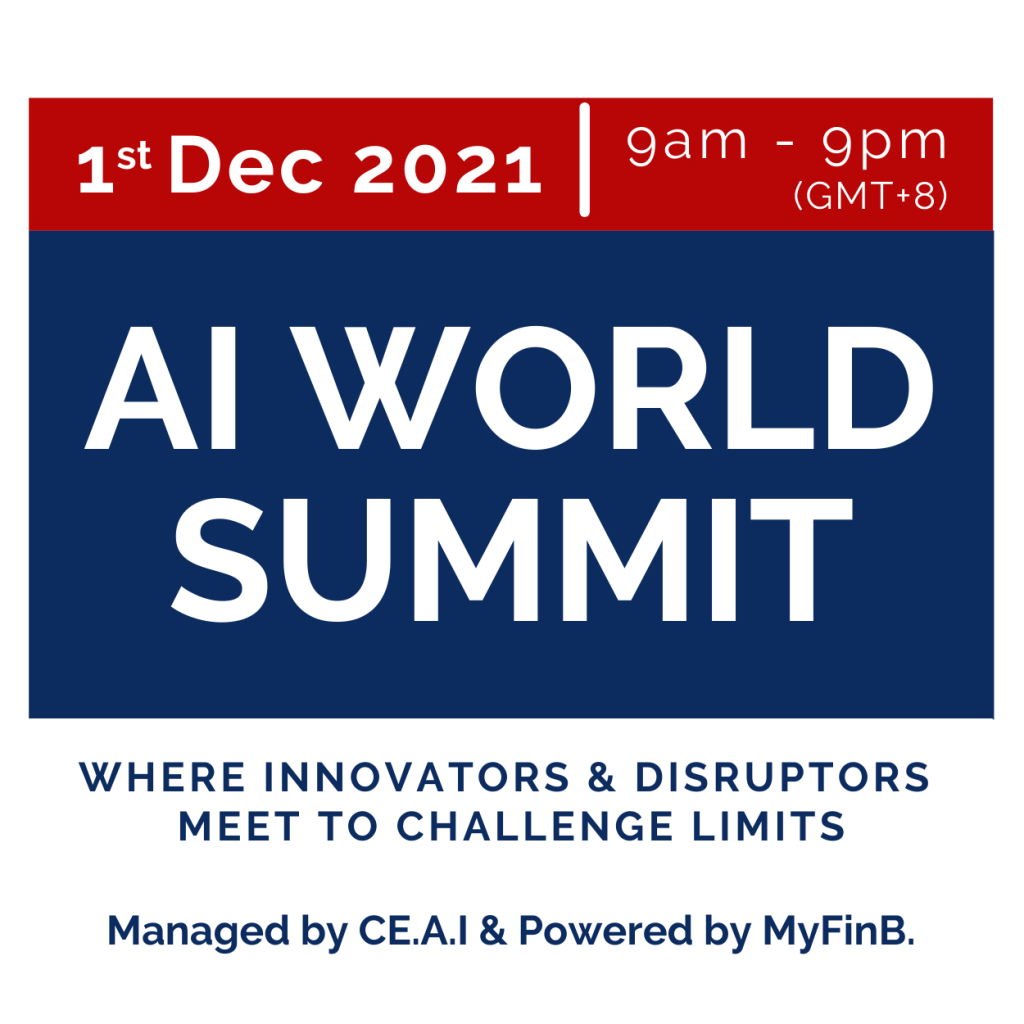

AIWS'21 // Track #4

#4 - Venture Capital vs Venture Building

Key discussion points

- Are these two approaches complementing or conflicting? Do they fill each other's gaps? If so, how?

- How should any of these be "modelled" for any AI deals? Please provide examples or scenarios.

- Which is the more effective model for Entrepreneurship and Innovation? Why is that so?

- Would there be any convergence between VC and VB, what can we expect to see ther interests in AI ventures in the near future, if any?

Creating value for entrepreneurs by way of dollar capital and expertise - but what do start-ups really need most?

SPEAKERS & SAYS

Stay tuned. More speakers are sharing their perspective soon.

1. Are these two approaches complementing or conflicting? Do they fill each other’s gaps? If so, how?

They’re complementing, part of each other. The VB will always need the VC to channel in the Funds and the VC will want to consider investing into quality deals churned by the VB. Unless if the VB already have their own pool of funds, it might not need the VC. It becomes like a Self-Growing and Sustaining garden not needing the farmer to water or fertilize it. The VC is the farmer in this instance. For more information you may read Jeff McDermott’s article on “What Venture Builders Do”.

2. How should any of these be “modelled” for any AI deals? Please provide examples or scenarios.

In this instance, MyFinB has become an AI Venture Builder, where it produces its own start-ups in AI. These AI models can be built and applied across industries. The parable to this is that of the Golden Goose. The VB will be the Golden Goose laying its Golden Eggs which are the Start-Ups it produce. The VC will then harvest the eggs bought from the Golden Goose and waits for it to hatch.

3. Which is the more effective model for Entrepreneurship and Innovation? Why is that so?

It depends. As some VCs do monitor very closely their investments and some also provide venture building services in terms of advisory but not producing their own start-ups. Both theme of entrepreneurship and innovation applies to both VB and VCs. The VCs have the advantage of going through many other dealflows/projects that comes from all over the world. The VB might be employing proprietary technology that the VC does not have to internally grow their own start-ups. The VB will have to find competent and committed Start-Up founders and management team to run their in-house bred start-ups. It depends on the positioning of each of the VC and VB.

The concept of VB came much later than VC. In actual fact, some VCs are already doing venture building work except that they don’t produce their own list of Start-Up but look outside to source for them. Back then there was no distinction made between VC and VB because we see that a lot of the VB work as being an inherent part of being a VC. However VC’s do not produce their own Start-Up as it might be in conflict with their structures, and deemed as not being impartial when it comes to making investment decision as we are deemed too close to the deal. Some VCs invest significant amount of time with the investee companies trying to better their structure, set-up and commercialization approaches, their financial positioning, the whole works, until we exit.

4. Would there be any convergence between VC and VB, what can we expect to see the interests in AI ventures in the near future, if any?

We see incoming convergence on VC+VB. Personally I know a few entities already doing this, they have their own funding and wants to grow the ventures themselves from within their Group. Usually their growth is organic and not via importation and acquisition of other existing running entities. However, they might also consider acquiring existing businesses depending on the suitability and ability of the investee co to work well with them. The thing with this model is that you have to have mastery of the technology, ample competent human capital and teams who knows their stuff and the necessary funding.

– Wan Fara Ayu w Ahmad – Co-Founder and CIO, Kanzun Ventures Management Sdn Bhd