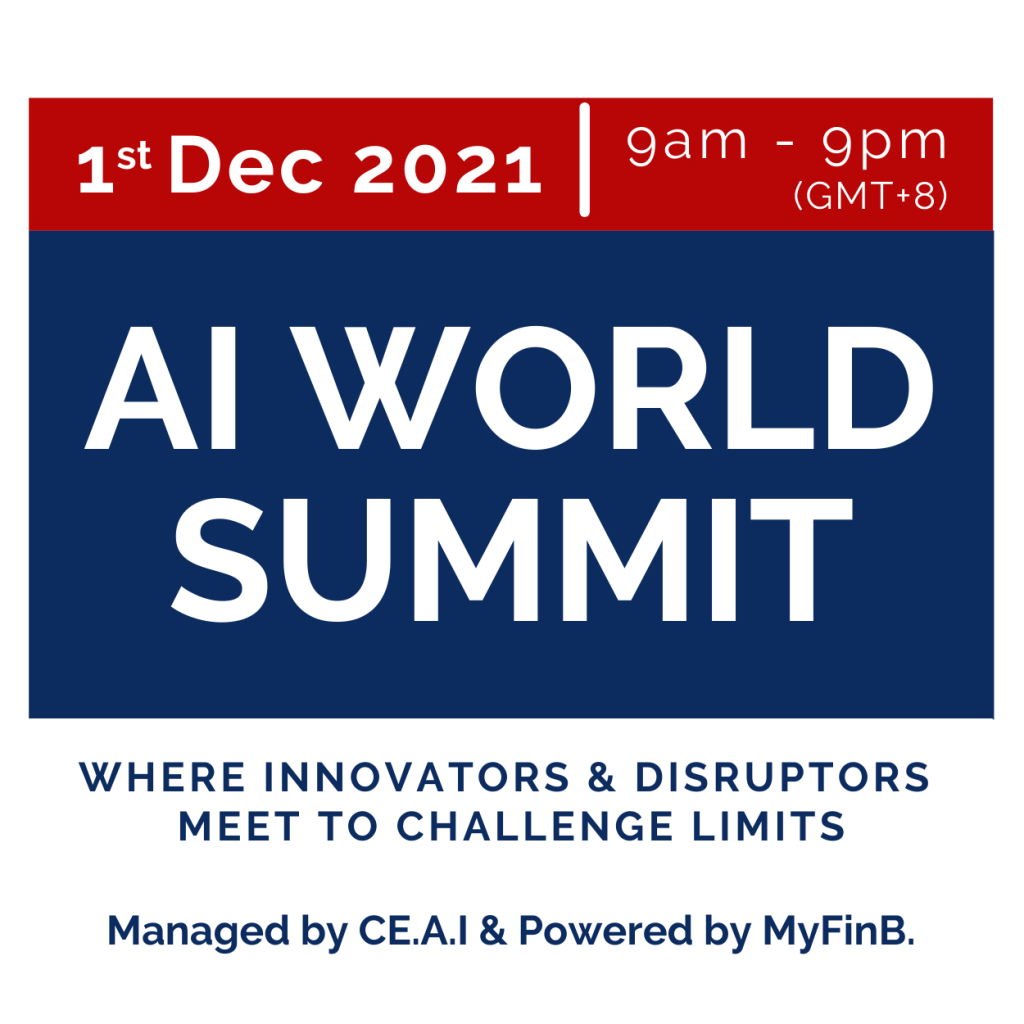

AIWS'21 // Track #5

#5 - Stock Investing & AI

Key discussion points

- What types of AI technology is being used to evaluate investment decisions? How do they work?

- What is AI saying about the current market situation and where is it expected to go in the coming future?

- Bottom-up versus Top-down investing approach - what is recommended for the short-term, and why? How could AI be deployed for either approach?

- Is AI better deployed for hunting small caps and midcaps or large caps in the coming quarter? What would AI be likely leaning towards?

Using Deep Learning AI to Predict the Stock Market: To what extent would this work for investment vs trading purposes?

SPEAKERS & SAYS

Stay tuned. More speakers are sharing their perspective soon.

1. What types of AI technology is being used to evaluate investment decisions?

There are various factors affecting Stock Market industry, both internal and external factors: Financial performance, management, industry performance, social awareness, government regulations, media, global events, trends, technological trends, etc.

In terms of AI, we should consider the above mentioned in terms of Fundamental Analysis and Technical Analysis.

2. How do they work?

– For Fundamental Analysis AI is not ready to integrate the appropriate algorithms (including macroeconomic factors), reliable to significant probability level.

– For Technical Analysis, using past performance to predict future market behaviour, identifying proper algorithms are relatively easier.

Utilising AI in Technical Analysis will be faster and produce more accurate results.

3. What is AI saying about the current market situation and where is it expected to go in the coming future?

Taking into consideration third wave of global pandemic and the experience gained the current trend will probably continue.

4. Bottom-up versus Top-down investing approach – what is recommended for the short-term, and why?

Short term investment decisions are preferable to be conducted with technical analysis, for which it is easier to identify and match proper algorithms. So, AI can with higher probability provide fast and accurate forecasting. Accordingly, for short term bottom up approach is more preferable.

5. How could AI be deployed for either approach?

– For Bottom-up approach Technical Analysis will be used, which is pretty straightforward for AI.

– For Top-Down approach Fundamental Analysis is applicable, which for AI is a challenging task from today’s perspective to create all of the above listed encompassing algorithms, able to predict stock market movements over 80- 95% accuracy.

6. Is AI better deployed for hunting small caps and midcaps or large caps in the coming quarter? What would AI be likely leaning towards?

Small caps and midcaps mostly have growth opportunities but are also more volatile and riskier investments than large caps.

Small and midcaps tend to be less influenced by global and macroeconomic factors. Thus, reliability factor for AI is higher and my preference goes to small and midcaps.

– Aieti G Kukava – CEO, Alliance Holding Group

Interested to speak @ AIWS'21?

If you are interested in becoming a speaker at AIWS 21/22, please kindly write to us at ceai@myfinb.com. Should you have any enquiries, please do not hesitate to get in touch with us.